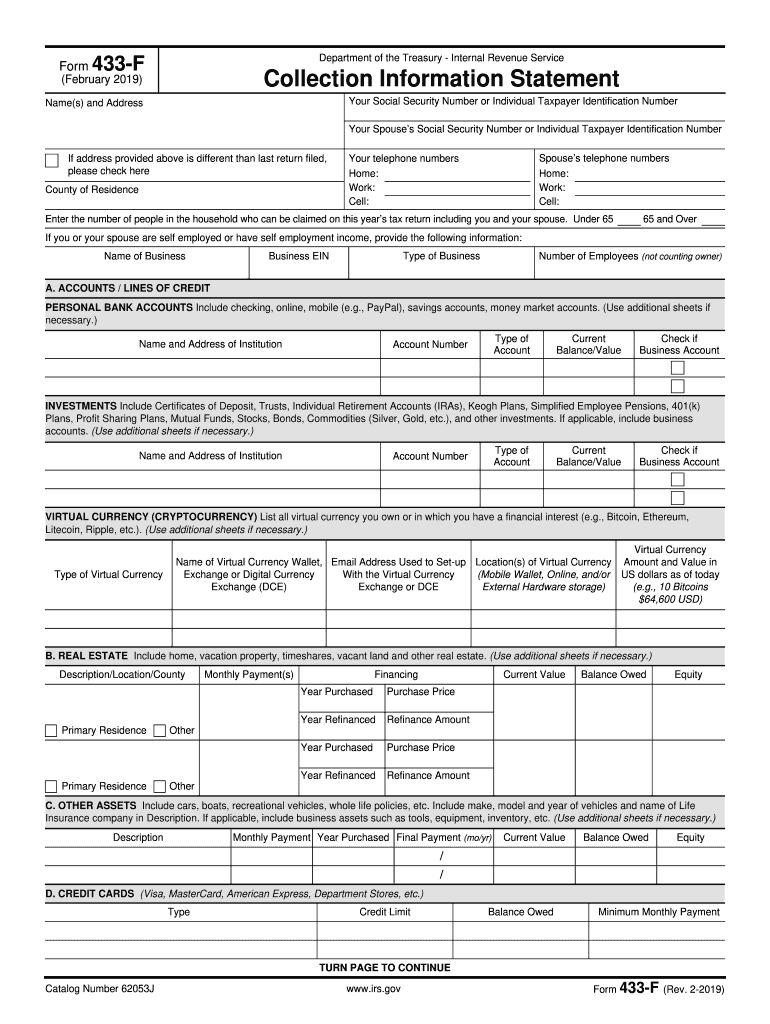

Complete employment information on Section F. Make an appointment Or call Then provide the business name, type of business, Business EIN and number of employees if either you or your spouse is self employed. Here are some tips for success when dealing with the IRS financial statements: This field is for validation purposes and should be left unchanged.

| Uploader: | Kazragar |

| Date Added: | 27 February 2014 |

| File Size: | 31.24 Mb |

| Operating Systems: | Windows NT/2000/XP/2003/2003/7/8/10 MacOS 10/X |

| Downloads: | 31569 |

| Price: | Free* [*Free Regsitration Required] |

Where to Send Non-Return Forms (Applications and Payments)

At the top left side of the form, write your name and address. If you have documentation, you will be asked to fax it to the IRS agent directly, but if you are missing one piece that they are looking for, you must call back after you retrieve the missing urs document s. The IRS is asking much fewer questions on the F.

Always call back to confirm. This is the most frustrating system in the world and the IRS knows it and does nothing to fix it. In E1, enter the amount owed to you or your business by writing the name, address 433d the amount owed and complete E2 only if your business accepts credit card payment. Ready to take the next step? Audits and tax notices.

Call Fresh Start Tax at Check the box below to get your in-office savings. Most taxpayers do not know the damage they can do to their case if they call the IRS.

Form F - Southern California - RJS Law - A Tax Law Firm

This is a switching station set up. Enter your credit card details in Section D. Use the lowest period of income to prove your case. Offers in Compromise are situations where the IRS will settle with a tax debtor in extenuating circumstances, thereby substantially reducing the tax liability owed. However, you are expected to check the box below it if the address provided is different from the last return filed.

Negotiate Offer in Compromise: While this might seem relatively straightforward, filers unfamiliar with the process may reveal far more than is necessary on the form, thereby increasing the monthly payment amount they will be responsible for under a monthly installment plan.

It will significantly change the outcome of a case and cause hardship for the financial life of the taxpayer. On the final payment column, enter the month and year. We do not control, evaluate, endorse or guarantee content found in those sites.

The details include the type, credit limit, balance owed and minimum monthly payment. Under the financing section, you are expected to write the year purchased, purchase price, year refinanced and refinanced amount.

It is this document alone and the corresponding documents that determines the outcome of your case. Check the applicable boxes and write the ies and tax per pay period as well as the length of time you have spent with your current employer and also your spouse.

The benefits of using Form 433F: Shorter, simpler disclosures to IRS collections

Financial Services Emerald Advance. If you have negative financial 4433f in your history, send it to them even if they do not ask for it. Do not call them until you do.

To begin with, the F is a more streamlined, simplified form, requiring fewer and simpler disclosures. Fill out other Assets in Section C which include car boat, recreational vehicles etc.

The download should begin automatically. Your email address will not be published. It includes alimony, child support, rental, social security income etc. Complete employment information on Section F. By clicking the button, I agree to the privacy policy and to hear about offers or services.

No comments:

Post a Comment